Trending...

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026 - 139

- Felicia Allen Hits #1 Posthumously with "Christmas Means Worship"

- Crovetti Orthopaedics Announces the Arrival of Dr. Philip Blaney, Bringing Expanded Sports Medicine Expertise to Southern Nevada

IQSTEL, Inc. (Stock Symbol: IQSTD) On Track Towards $1 Billion in Revenue by 2027.

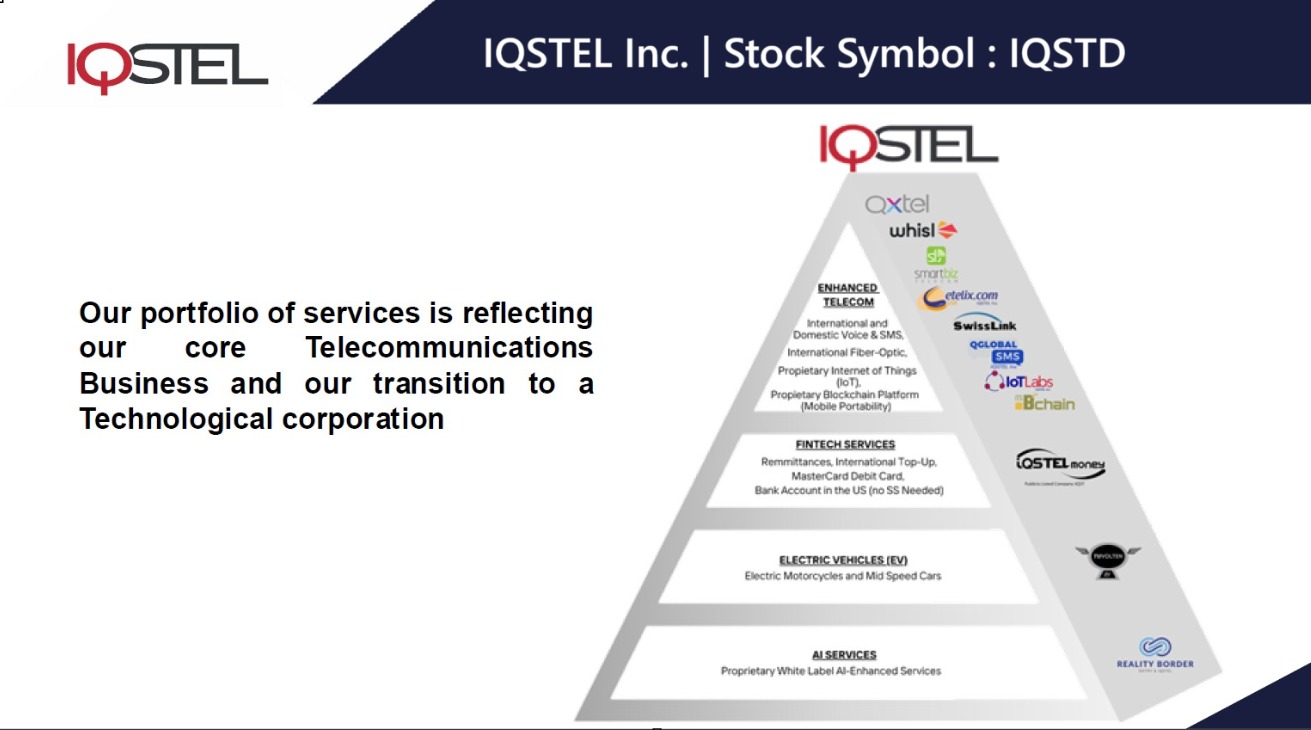

CORAL GABLES, Fla. - nvtip -- Diversified Business with Divisions Focused on Telecommunications, Fintech, Electric Vehicles, Artificial Intelligence and More.

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

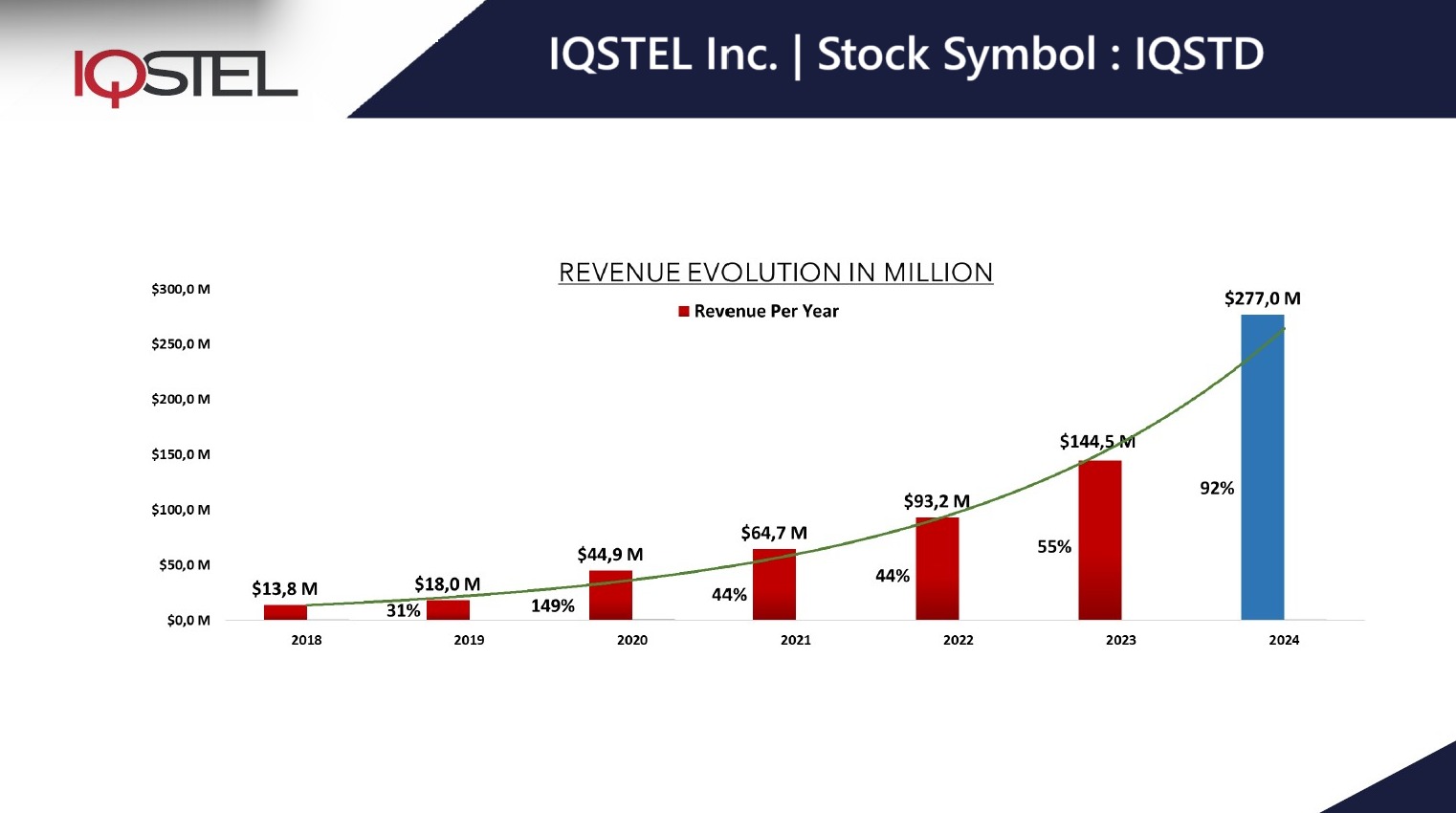

More on nvtip.com

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on nvtip.com

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

$340 Million Revenue Forecast for 2025.

New Rebrand Program with Expansion into Fintech, AI and Cybersecurity to Address Challenges Across Multiple Industries.

Completed 11 Acquisitions Since 2018 and Actively Pursuing More.

Preliminary Q1 2025 Delivering Net Revenue of $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Strategic Decision to Uplist to NASDAQ for Multiple Corporate Advantages Utilizing Reverse Stock Split to Meet Minimum Listing Requirements.

MOU to Acquire Majority Stake in Fintech Leader GlobeTopper, Driving Fintech Expansion and Strengthening Revenue Outlook.

IQSTD Shareholders to Receive ASII Common Shares as a Dividend as Part of Nasdaq Uplisting Plan.

IQSTEL, Inc. (Stock Symbol: IQSTD) is a US-based multinational company in the final stages of the path to becoming listed on Nasdaq. IQSTD offers cutting-edge solutions in Telecom, Fintech, Blockchain, Artificial Intelligence (AI), and Cybersecurity. Operating in 21 countries, IQSTD delivers high-value, high-margin services to its extensive global customer base. IQSTD projects $340 million in revenue for FY-2025, building on its strong business platform.

IQSTD has been building a strong business platform with its customers, selling them millions of dollars per month, and by leveraging this trust, the company is now beginning to sell high-tech, high-margin products across its divisions. IQSTD is strategically positioned to achieve $1 billion in revenue by 2027 through organic growth, acquisitions, and high-margin product expansion.

Strong Preliminary Q1 2025 Results: Revenue Growth, Margin Expansion and Strategic Progress Toward NASDAQ Uplisting

On May 6th IQSTD announced its preliminary first quarter 2025 financial results, delivering strong double-digit growth in revenue and a 40% increase in gross profit, reflecting continued improvements toward achieving profitability. These results reinforce the company's commitment to long-term value creation through strategic initiatives, including its planned NASDAQ uplisting and acquisition-driven growth strategy.

More on nvtip.com

- UK Financial Ltd Launches U.S. Operations Following Delaware Approval

- Southern Utah Adventure Center Sets the Standard for All-Inclusive Off-Road Adventures

- NewGen Business Solutions Named Oracle NetSuite 2025 Microvertical Partner of the Year

- Pinealage: the app that turns strangers into meditation companions — in crowdfunding phase

- "Micro-Studio": Why San Diegans are Swapping Crowded Gyms for Private, One-on-One Training at Sweat Society

IQSTD has a successful track record of improving year over year across key operational financial metrics—including revenue, gross profit, EBITDA, assets, among others—while growing at a gigantic pace of 96% year-over-year. This performance demonstrates consistent execution and the scalability of its business model.

Preliminary Q1 2025 Financial Highlights

Net Revenue: $57.6 million, a 12% increase from $51.4 million in Q1 2024.

Gross Profit: $1.93 million, a 40% increase from $1.38 million in Q1 2024.

Gross Margin: Improved to 3.36%, a 25% increase from 2.68% in Q1 2024.

Adjusted EBITDA (Telecom Division): $593,604.

Q4 2024 Revenue Reference: $98.8 million, highlighting the company's strong momentum heading into 2025. Historically, IQSTEL's second-half performance has significantly outpaced the first half, reinforcing confidence in continued growth.

The IQSTD business platform is the result of years of sustained effort, technological development, and commercial trust-building. Establishing this platform required securing interconnection agreements with the largest telecommunications networks worldwide—a process that is highly complex, resource-intensive, and not easily replicated.

IQSTD has successfully built a global network of trusted customers and vendors, exchanging hundreds of millions of dollars annually. This level of commercial reliability and mutual trust has created a resilient and strategically valuable operating ecosystem.

IQSTD has built a stable and scalable business model. With the platform firmly in place, IQSTD is now leveraging it to offer high-tech, high-margin products—including AI-powered tools, fintech services, and cybersecurity solutions—through its existing global customer base.

Strategic Decision to Uplist to NASDAQ Utilizing Reverse Stock Split to Meet Minimum Listing Requirements

On May 2nd IQSTD announced the strategic decision to uplist to the NASDAQ stock exchange. As part of this process, IQSTD has executed a reverse stock split at a ratio of 80:1 to meet the minimum share price required for listing. With $283 million in revenue reported for 2024 and a 96% year-over-year growth rate, IQSTD is poised to enter a new phase of growth and recognition on a national exchange.

More on nvtip.com

- Beycome Closes $2.5M Seed Round Led by InsurTech Fund

- Tru by Hilton Columbia South Opens to Guests

- Christy Sports donates $56K in new gear to SOS Outreach to help kids hit the slopes

- "BigPirate" Sets Sail: A New Narrative-Driven Social Casino Adventure

- Phinge CEO Ranked #1 Globally by Crunchbase for the Last Week, Will Be in Las Vegas Jan. 4-9, the Week of CES to Discuss Netverse & IPO Coming in 2026

As a result of the reverse split, there will be approximately 2,633,878 shares of common stock outstanding. Upon the effectiveness of the reverse split, there will also be a proportional decrease of the Company's authorized shares of common stock at the same ratio of 1-for-80, resulting in approximately 3,750,000 authorized shares of common stock following the action.

IQSTD is actively seeking new acquisitions in telecom, new telecom technologies and fintech that contribute positive EBITDA and align with its long-term vision of building a profitable $1 billion revenue company.

In 2025 and beyond, IQST will leverage this established platform to accelerate expansion into high-tech, high-margin industries, unlocking new revenue streams and maximizing profitability.

Cybersecurity Solutions: Providing cutting-edge security services tailored for global telecom operators and enterprises.

Advanced Telecom Services: Expanding high-value offerings such as next-generation voice, messaging, and connectivity solutions.

Fintech Innovation: Strengthening financial technology services, including digital payments, mobile banking, and international remittances.

AI-Driven Technologies: Integrating artificial intelligence to enhance customer experience, automation, and operational efficiencies.

IQSTD plans to distribute common stock in ASII to its shareholders as a dividend. The Company believes this decision not only rewards current investors but also aligns with IQSTD broader efforts to enhance shareholder participation and liquidity.

For more information on $IQSTD visit: www.iQSTEL.com

IQST Media Contact:

Company: iQSTEL, Inc. (Stock Symbol: IQSTD)

Contact: Leandro Jose Iglesias, President and CEO

Email: investors@iqstel.com

Phone: +1 954-951-8191

Country: United States

Website: www.iQSTEL.com

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on nvtip.com

- Record Revenue, Tax Tailwinds, and AI-Driven Scale: Why Off The Hook YS Inc. Is Emerging as a Standout in the $57 Billion U.S. Marine Market

- VSee Health (N A S D A Q: VSEE) Secures $6.0M At-Market Investment, Accelerates Expansion as Revenues Surge

- Children Rising Appoints Marshelle A. Wilburn as New Executive Director

- Fairmint CEO Joris Delanoue Elected General Director of the Canton Foundation

- Sleep Basil Mattress Co.'s Debuts New Home Page Showcasing Performance Sleep Solutions for Active Denver Lifestyles

- Bent Danholm Joins The American Dream TV as Central Florida Host

- The Nature of Miracles Celebrates 20th Anniversary Third Edition Published by DreamMakers Enterprises LLC

- Artificial Intelligence Leader Releases Children's Book on Veterans Day

- Felicia Allen Hits #1 Posthumously with "Christmas Means Worship"

- CCHR Documentary Probes Growing Evidence Linking Psychiatric Drugs to Violence

- Delirious Comedy Club And House Of Magic Expand To New Larger Location At Silver Sevens

- Valhallan Esports and XP League Unite to Expand Opportunity in Youth Esports

- Tokenized Real-World Assets: Iguabit Brings Institutional Investment Opportunities to Brazil

- MEX Finance meluncurkan platform keuangan berbasis riset yang berfokus pada data, logika, dan efisiensi pengambilan keputusan investasi

- From MelaMed Wellness to Calmly Rooted: A New Chapter in Functional Wellness

- New Angles US Group Founder Alexander Harrington Receives Top U.S. Corporate Training Honor and Leads Asia-Pacific Engagements in Taiwan

- UK Financial Ltd Board of Directors Establishes Official News Distribution Framework and Issues Governance Decision on Official Telegram Channels

- UK Financial Ltd Sets Official 30-Day Conversion Deadline for Three Exchange Listed Tokens Ahead of Regulated Upgrade

- New Jersey Therapy and Life Coaching Unveils Original Dan Fenelon Mural in Voorhees New Jersey Therapy Office

- Kentucky Judges Ignore Evidence, Prolong Father's Ordeal in Baseless Case