Trending...

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

Cycurion, Inc. (N A S D A Q: CYCU) $CYCU Just Completed Restructuring Resulting in a Very Attractive OS Count of 2.88 Million Supporting Continued NASDAQ Listing and Higher Access to Institutional Investors

MCLEAN, Va. - nvtip -- N A S D A Q-listed AI-driven cybersecurity innovator Cycurion, Inc. (N A S D A Q: CYCU) $CYCU is making significant strides toward long-term growth and profitability, powered by a record-breaking $73.6 million multi-year backlog, new government contracts, and a transformative restructuring that positions the Company for institutional investor engagement and sustained N A S D A Q compliance.

A New Era for AI-Powered Cybersecurity

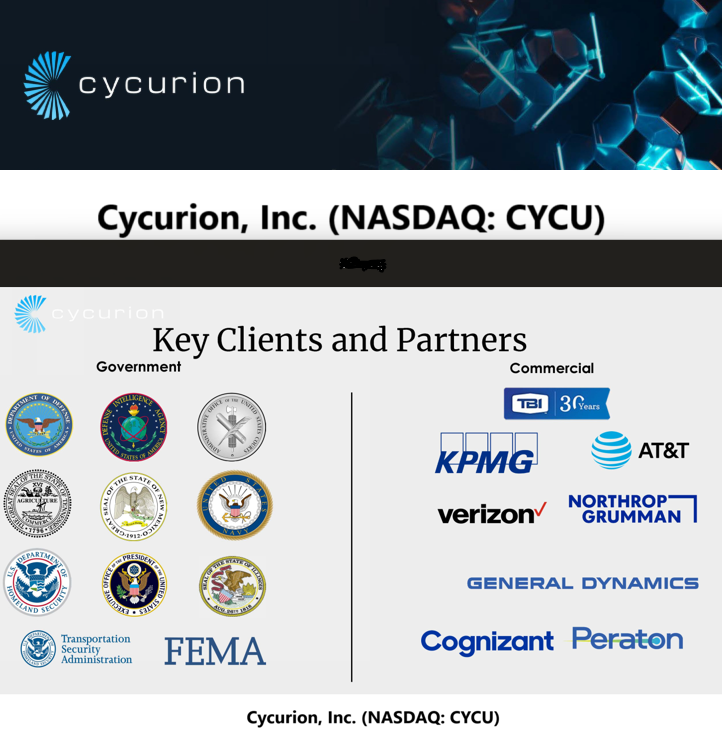

With global cyber threats intensifying across government and enterprise sectors, Cycurion's proprietary AI-infused ARx and Cyber Shield platforms deliver next-generation protection through a multi-layered SaaS model designed to prevent, detect, and neutralize threats in real time. The Company's technology is being adopted by some of the world's most demanding clients—including the U.S. Department of Defense, Department of Homeland Security, Defense Intelligence Agency, and U.S. Navy, as well as leading Fortune 100 and 500 corporations.

Founded by internet pioneer Emmit McHenry, who helped develop the first internet protocols and the creation of ".com" domains, Cycurion has deep roots in the digital evolution. Under the leadership of Chairman and CEO L. Kevin Kelly, the Company is leveraging advanced AI and machine learning to redefine cybersecurity through predictive threat intelligence and data-driven automation.

Florida State Term Contract: A Major Government Win

On October 29, 2025, Cycurion was selected as an approved vendor under the Florida State Term Contract for Information Technology (IT) Staff Augmentation Services, marking a major milestone in the Company's government sector expansion.

This multi-year contract allows Cycurion to deploy top-tier IT and cybersecurity professionals directly to Florida state agencies, counties, and municipalities—without competitive rebidding—covering services across AI integration, cloud engineering, cybersecurity, data analytics, and project management.

This strategic win positions Cycurion at the forefront of Florida's IT modernization initiative, while creating new recurring revenue opportunities that reinforce its long-term growth trajectory.

More on nvtip.com

Record $73.6 Million Backlog Underpins Growth Visibility

Cycurion's backlog has surged to a record $73.6 million, spanning multi-year agreements with federal, state, local, and private sector clients. This includes over $8 million in new contracts secured in Q2 2025 alone, such as a $6 million municipal transportation agency contract for AI-powered cybersecurity and IT modernization, and an additional $4.6 million in new awards across healthcare and public safety.

The Company's growing AI-driven service portfolio has boosted its annualized revenue run-rate to $16 million, while the backlog provides more than 18 months of forward revenue visibility—a key metric for institutional investors seeking stability and scalability.

AI Meets Cybersecurity: Expanding Margins and Recurring Revenue

Cycurion's flagship ARx platform has been in development for over five years and is now being commercialized across government and enterprise clients. Its AI-based predictive threat mitigation and multi-layer protection create a recurring revenue model with expanding gross margins, setting the stage for robust profitability in 2026 and beyond.

The Company is currently having its ARx intellectual property independently valued, a process expected to enhance its balance sheet and enterprise value while attracting investors focused on AI-driven innovation.

Key Investment Highlights

Trusted Partnerships with Leading Institutions

CYCU's credibility and proven performance continue to attract top-tier clients and partners. The company serves mission-critical agencies and enterprises, including:

Additionally, Cycurion's partnerships with healthcare organizations affiliated with the National Association of County and City Health Officials (NACCHO) extend its reach into a $3 billion+ cybersecurity market. CYCU's NACCHO Cyber Shield program alone is expected to deliver $1.8 million in first-year revenue.

More on nvtip.com

Strategic Acquisitions Fueling AI Leadership

Cycurion's disciplined acquisition strategy continues to accelerate both innovation and market expansion. Subsidiaries including Axxum Technologies, Cloudburst Security, and Cycurion Innovation have deepened CYCU's technology stack with advanced AI algorithms and quantum-resistant cybersecurity frameworks.

Further partnerships — such as the LSV-TECH alliance in Latin America and the iQSTEL (IQST) equity exchange — are expanding CYCU's geographic and technological footprint. As part of the iQSTEL partnership, half of the stock received by CYCU will be distributed to shareholders as a dividend, enhancing shareholder value.

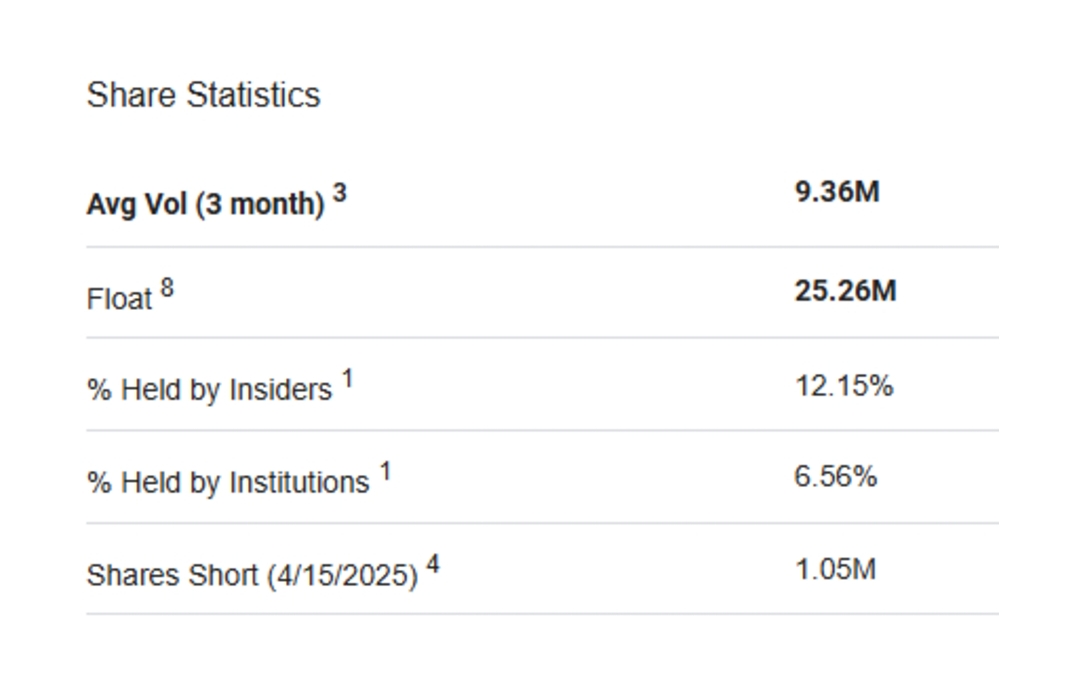

Restructuring and Realignment: Ready for Institutional Capital

CYCU is structured for sustainable growth and institutional participation. With only 2.88 million shares outstanding, CYCU's lean equity base enhances valuation potential, supports ongoing Nasdaq compliance, and positions the company to attract long-term institutional investors.

CYCU has already met with 17 institutional firms — most requiring share prices in the $3–$5 range — and has seen heightened investor interest across Asia-Pacific markets, including Japan, Korea, Singapore, China, and Australia.

Strengthened Financial Position for 2026

CYCU enters 2026 in a much stronger financial position:

These improvements offer CYCU significant flexibility to fund acquisitions, scale operations, and execute on its $73.6 million backlog without excessive reliance on debt.

Looking Ahead

As CYCU expands recurring revenue through its AI-infused platforms and multi-year government and enterprise contracts, the company is well positioned to deliver ballistic returns in 2026. Its strategic financial realignment, strong backlog visibility, and partnerships with the world's most trusted institutions provide a powerful foundation for long-term shareholder value.

For more information, visit: www.cycurion.com

Investor Contact:

Cycurion, Inc. (N A S D A Q: CYCU)

Kevin Kelly, Chairman & CEO

📧 info@cycurion.com | 📞 888-341-6680

United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

A New Era for AI-Powered Cybersecurity

With global cyber threats intensifying across government and enterprise sectors, Cycurion's proprietary AI-infused ARx and Cyber Shield platforms deliver next-generation protection through a multi-layered SaaS model designed to prevent, detect, and neutralize threats in real time. The Company's technology is being adopted by some of the world's most demanding clients—including the U.S. Department of Defense, Department of Homeland Security, Defense Intelligence Agency, and U.S. Navy, as well as leading Fortune 100 and 500 corporations.

Founded by internet pioneer Emmit McHenry, who helped develop the first internet protocols and the creation of ".com" domains, Cycurion has deep roots in the digital evolution. Under the leadership of Chairman and CEO L. Kevin Kelly, the Company is leveraging advanced AI and machine learning to redefine cybersecurity through predictive threat intelligence and data-driven automation.

Florida State Term Contract: A Major Government Win

On October 29, 2025, Cycurion was selected as an approved vendor under the Florida State Term Contract for Information Technology (IT) Staff Augmentation Services, marking a major milestone in the Company's government sector expansion.

This multi-year contract allows Cycurion to deploy top-tier IT and cybersecurity professionals directly to Florida state agencies, counties, and municipalities—without competitive rebidding—covering services across AI integration, cloud engineering, cybersecurity, data analytics, and project management.

This strategic win positions Cycurion at the forefront of Florida's IT modernization initiative, while creating new recurring revenue opportunities that reinforce its long-term growth trajectory.

More on nvtip.com

- CCHR: Harvard Review Exposes Institutional Corruption in Global Mental Health

- IoT Marketing to Officially Launch Tech Scope Connect at CES After Party

- Goatimus Launches Dynamic Context: AI Prompt Engineering Gets Smarter

- Global License Exclusive Secured for Emesyl OTC Nausea Relief, Expanding Multi-Product Growth Strategy for Caring Brands, Inc. (N A S D A Q: CABR)

- RNHA Affirms Support for President Trump as Nation Marks Historic Victory for Freedom

Record $73.6 Million Backlog Underpins Growth Visibility

Cycurion's backlog has surged to a record $73.6 million, spanning multi-year agreements with federal, state, local, and private sector clients. This includes over $8 million in new contracts secured in Q2 2025 alone, such as a $6 million municipal transportation agency contract for AI-powered cybersecurity and IT modernization, and an additional $4.6 million in new awards across healthcare and public safety.

The Company's growing AI-driven service portfolio has boosted its annualized revenue run-rate to $16 million, while the backlog provides more than 18 months of forward revenue visibility—a key metric for institutional investors seeking stability and scalability.

AI Meets Cybersecurity: Expanding Margins and Recurring Revenue

Cycurion's flagship ARx platform has been in development for over five years and is now being commercialized across government and enterprise clients. Its AI-based predictive threat mitigation and multi-layer protection create a recurring revenue model with expanding gross margins, setting the stage for robust profitability in 2026 and beyond.

The Company is currently having its ARx intellectual property independently valued, a process expected to enhance its balance sheet and enterprise value while attracting investors focused on AI-driven innovation.

Key Investment Highlights

- $73.6 Million Multi-Year Backlog spanning 1–5 years

- Florida State Term Contract Award for IT modernization and staff augmentation

- AI-Driven SaaS Platforms (ARx, Cyber Shield) powering cybersecurity innovation

- Attractive Share Structure: Only 2.88 million OS post-restructuring

- Reduced Debt by $3.2 Million and strengthened balance sheet

- Growing Institutional and International Investor Interest

- Strategic Partnerships with U.S. Government, NACCHO, and Fortune 500 clients

- Recurring Revenue and Margin Expansion expected to accelerate in 2026

Trusted Partnerships with Leading Institutions

CYCU's credibility and proven performance continue to attract top-tier clients and partners. The company serves mission-critical agencies and enterprises, including:

- U.S. Department of Defense

- Department of Homeland Security

- Defense Intelligence Agency

- U.S. Navy

- Fortune 100 & 500 corporations

Additionally, Cycurion's partnerships with healthcare organizations affiliated with the National Association of County and City Health Officials (NACCHO) extend its reach into a $3 billion+ cybersecurity market. CYCU's NACCHO Cyber Shield program alone is expected to deliver $1.8 million in first-year revenue.

More on nvtip.com

- American Laser Study Club Announces 2026 Kumar Patel Prize in Laser Surgery Recipients: Ann Bynum, DDS, and Boaz Man, DVM

- Lineus Medical Completes UK Registration for SafeBreak® Vascular

- Canyons & Chefs Announces Revamped Homepage

- $140 to $145 Million in 2026 Projected and Profiled in New BD Deep Research Report on its Position in $57 Billion US Marine Industry; N Y S E: OTH

Strategic Acquisitions Fueling AI Leadership

Cycurion's disciplined acquisition strategy continues to accelerate both innovation and market expansion. Subsidiaries including Axxum Technologies, Cloudburst Security, and Cycurion Innovation have deepened CYCU's technology stack with advanced AI algorithms and quantum-resistant cybersecurity frameworks.

Further partnerships — such as the LSV-TECH alliance in Latin America and the iQSTEL (IQST) equity exchange — are expanding CYCU's geographic and technological footprint. As part of the iQSTEL partnership, half of the stock received by CYCU will be distributed to shareholders as a dividend, enhancing shareholder value.

Restructuring and Realignment: Ready for Institutional Capital

CYCU is structured for sustainable growth and institutional participation. With only 2.88 million shares outstanding, CYCU's lean equity base enhances valuation potential, supports ongoing Nasdaq compliance, and positions the company to attract long-term institutional investors.

CYCU has already met with 17 institutional firms — most requiring share prices in the $3–$5 range — and has seen heightened investor interest across Asia-Pacific markets, including Japan, Korea, Singapore, China, and Australia.

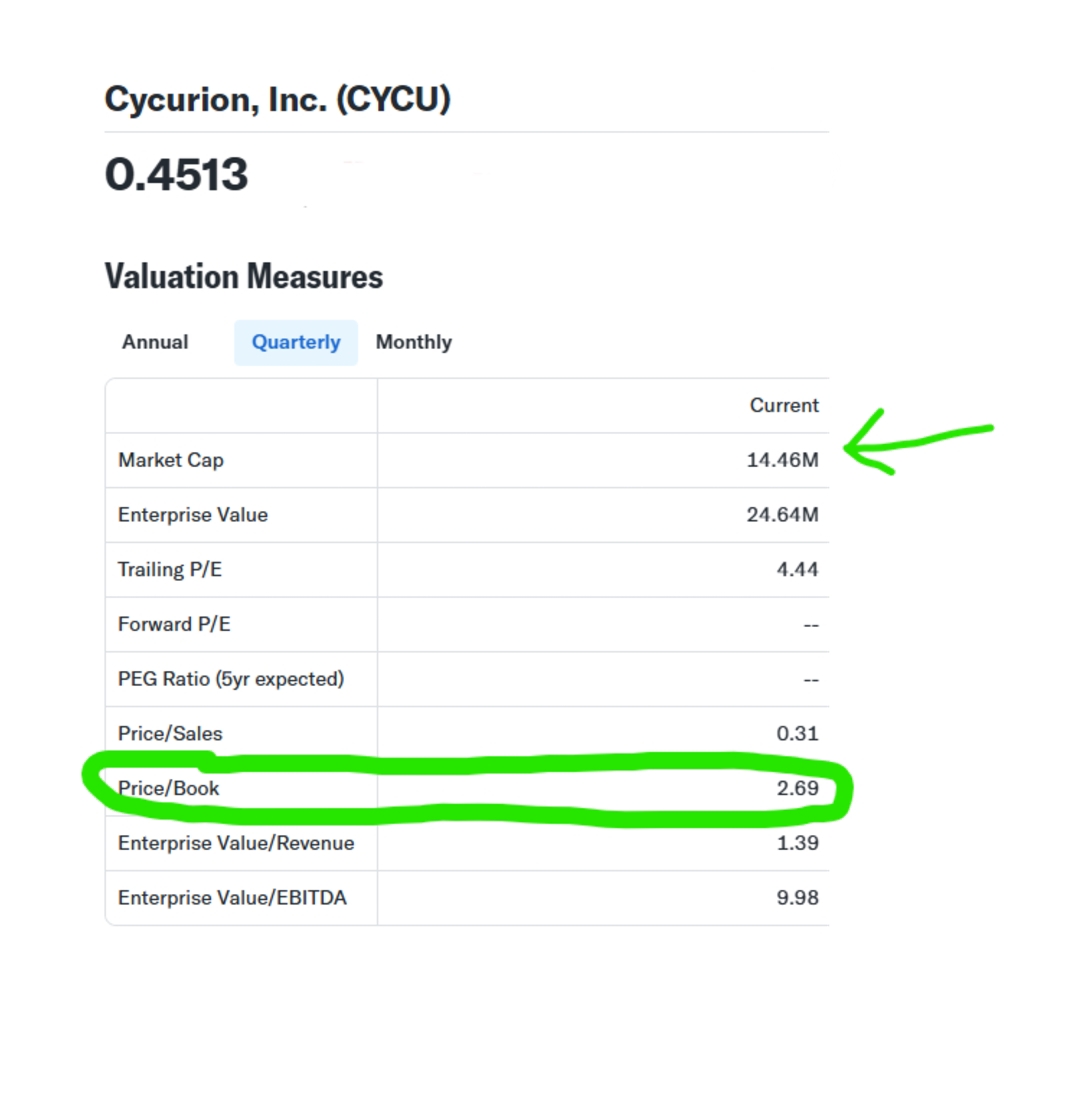

Strengthened Financial Position for 2026

CYCU enters 2026 in a much stronger financial position:

- Debt reduced by $3.2 million.

- Stockholders' equity of $10.4 million (Q2 2025).

- $45 million available on its $60 million equity line of credit.

These improvements offer CYCU significant flexibility to fund acquisitions, scale operations, and execute on its $73.6 million backlog without excessive reliance on debt.

Looking Ahead

As CYCU expands recurring revenue through its AI-infused platforms and multi-year government and enterprise contracts, the company is well positioned to deliver ballistic returns in 2026. Its strategic financial realignment, strong backlog visibility, and partnerships with the world's most trusted institutions provide a powerful foundation for long-term shareholder value.

For more information, visit: www.cycurion.com

Investor Contact:

Cycurion, Inc. (N A S D A Q: CYCU)

Kevin Kelly, Chairman & CEO

📧 info@cycurion.com | 📞 888-341-6680

United States

DISCLAIMER: https://corporateads.com/disclaimer/

Disclosure listed on the CorporateAds website

Source: Corporate Ads

0 Comments

Latest on nvtip.com

- Standard Forwarding Freight, a long-standing regional carrier, has suspended operations

- Lacy Hendricks Earns Prestigious MPM® Designation from NARPM®

- Walmart $WMT and COSTCO.COM $COST Distribution as SonicShieldX™ Platform Sets the Stage for Accelerated Growth in 2026: AXIL Brands (N Y S E: AXIL)

- AI-Driven Drug Development with Publication of New Bioinformatics Whitepaper for BullFrog AI: $BFRG Strengthens Its Position in AI Drug Development

- IQSTEL Enters 2026 from a Position of Strength Following Transformational Year Marked by N A S D A Q Uplisting, Record Revenue and First-Ever

- Are You Hiring The Right Heater Repair Company in Philly?

- Mbariket Sets Goal of 20,000 YouTube Subscribers by Jan 1, 2026, Building a Trusted Media Platfor

- IAI Smart Inc. to Unveil Offline-Capable SmartVoice™ Product Line Under Emerson Smart at CES 2026

- Will Affordability Return to Vegas? Trang Hooser Las Vegas Realtor Unveils 2026 Forecast

- Appliance EMT Expands Professional Appliance Repair Services to Hartford, Connecticut

- Java Holdings LLC Acquires +Peptide, Expanding Portfolio Across Coffee, Science, and Functional Nutrition

- OneSolution® Expands to Orlando with New Altamonte Springs Implant Center

- Indian Peaks Veterinary Hospital Launches Updated Dental Services Page for Boulder Pet Owners

- Cocoa Dolce Crafts Artisan Chocolate Gift for Paul McCartney at Las Vegas "Got Back" Concert

- Dugan Air Donates $10,000 to Indian Creek Schools

- Robert DeMaio, Phinge Founder & CEO, Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- 2025: A Turning Point for Human Rights. CCHR Demands End to Coercive Psychiatry

- The 22% Tax Reality: Finland's New Gambling Law Creates a "Fiscal Trap" for Grey Market Casino Players

- Phinge Founder & CEO Robert DeMaio Ranked #1 Globally on Crunchbase, Continues to Convert Previous Debt Owed to Him by Phinge into Convertible Notes

- TIA LYNN — a new direction, a higher level. 2026 it's up